You may not have heard of Tubi, Pluto TV, or Kanopy—but they're the perfect cure for subscription fatigue. THE MAIN CASUALTY of the streaming wars so far has been your wallet. Netflix, Amazon, Hulu, CBS All Access, HBO Now, Apple TV+, Disney+: They all demand a monthly tithe. Toss in a live service like YouTube TV, the music app of your choice, and whatever gaming concoction suits your needs, and you're suddenly ringing up a pretty grim bill. But wait! The proliferation of streaming services has also yielded a bumper crop of free options. They're the perfect cure for subscription fatigue. The adage "you get what you pay for" does apply here to some extent. The selections generally aren't huge, and most make you watch a few ads along the way. But they're also better than you might expect, and continuing to improve. On Wednesday, popular streaming platform Plex introduced an ad-supported movie and TV show library with thousands of titles, with about half the ads you'd expect from broadcast television viewing. In other words, while you shouldn't expect any of the following to replace Netflix from your streaming regimen, you shouldn't count them out either. Each almost certainly offers at least something you want to watch, and won't cost you an arm and a leg—or anything at all—to take advantage. Plex We just talked about this one! But more specifically, Plex makes a compelling case by partnering with big-name studios like MGM, Lionsgate, and Warner Bros., which means it has a relatively well-stocked streaming larder focused on classics: The Right Stuff, Raging Bull, and Apocalypse Now just for starters. It also carved out international licensing deals, meaning unlike many streaming services, your library won't suddenly disappear when you travel. IMDb TV To access the IMDb library, you'll need to create an account, or use your existing Amazon credentials. Your current options are decent but not great; the most popular movie appears to be Fury, although bonus points for also carrying Sing Street. Your best bet for a binge is probably sci-fi series Fringe, and not just because it rhymes. Even though it's getting a deluge of new content, it's probably unlikely that IMDb TV will ever catch up to its Prime Video sibling, so manage those expectations accordingly. The Roku Channel OK, this could potentially be confusing, since Roku is made up of thousands of "channels," including the majors like Hulu and HBO Now. But it also operates the Roku Channel, which offers a smorgasbord of classics like Groundhog Day and Tombstone, along with slightly more recent fare like Spotlight. But really the important thing to know is that it has all five seasons of the incomparable Schitt's Creek. You're welcome! The more interesting reason to take a look at the Roku Channel, though, is that it also offers free livestreaming, including news reports from ABC and indie movies and classic TV from Filmrise. During a Friday afternoon check-in, the latter was playing a black and white episode of Lost in Space. Fun! You can also subscribe to other streaming services—HBO, Showtime, Acorn TV, and so on—through the Roku Channel, which should save you some navigational clicks. Again, if you already have the Roku app on your smartphone, the Roku Channel is right there waiting for you. Or you can get it—and everything else on this list—through your Roku device. Kanopy Do you have a library card? Then you have Kanopy! Well, sort of. You still have to sign up for a separate Kanopy account, but once you have, you can connect it to your public library, assuming you're a member, which you should be because libraries are great! Individual libraries set their own limits; mine allows for 10 movies a month, with three days to watch from the time you press play. Your credits refresh on the first of each month, and there are apps available for Android, iOS, Apple TV, Fire TV, Roku, and so on. The selection here leans toward indies, but it includes lots of Criterion Collection flicks like The 400 Blows and Rashomon, making it a cinephile's dream. Also? No ads. Libraries! Hoopla is another library-connected service that has a great selection but no Criterion. On the plus side, you can also manage your library ebooks, comics, and other media through it, while Kanopy is strictly video. So do with that what you will. Tubi Tubi lacks the name recognition of some of its peers, but its library outpaces most of them, with thousands of ad-supported TV and movie titles. You don't even need to register an account to watch. It also arranges its haul into helpful categories—including a "Not on Netflix" collection to help you better appreciate what you're not paying for. There's still a lot of junk to sift through on Tubi, but it doesn't take long to turn up rewatchable classics like Ronin, art-house hits like Nebraska, and underappreciated gems like The Host. Pluto TV Most of the streaming services on this list specialize in on-demand content. Not so the Viacom-owned Pluto TV, which replicates the traditional cable-viewing menu, but with specialized channels serving up nonstop Doctor Who, Antiques Roadshow, and even The Hills. It also has traditional networks, like CNN and Fox Sports. There are hundreds of channels to surf through in all, as well as a slightly anemic on-demand selection of movies and TV shows. Basically, if you've got decision fatigue—if you're tired of wasting an hour scrolling through Netflix before you actually watch anything—Pluto is the elixir you're looking for. Crackle Did you know that Sony Crackle has been around in one form or another since 2004? That's three years before Netflix started streaming. That head start may not have won it a massive following, but Crackle does house some gems, particularly in the realm of cult and classic TV. You can binge the entirety of News Radio and Parker Lewis Can't Lose, and early seasons of All in the Family and Bewitched. Relatively rare for a free streaming service, Crackle also has original shows like Rob Riggle's Ski Master Academy and the very much less ridiculous The Oath. There are plenty of movies here, too, spanning decades but with a heavy concentration of '90s classics like Jerry Maguire and In the Line of Fire. You don't need an account to watch, and the content gets updated pretty regularly. Vudu You already know Vudu as the Walmart movie rental service you never use. But Vudu is also a Walmart free movie and TV streaming service you never use! The selection isn't great, or at least not appreciably better than your other options here. (In fairness, it does feature The Rock). But keep an eye on Vudu; it's investing in original programming, which includes a sci-fi drama called Albedo, starring Evangeline Lilly and directed by Brad Peyton, who has directed the actor known as the Rock in three feature films. Impossible to say if it'll be any good. But at least it'll be free.

0 Comments

Story by Alejandro Cremades Former Contributor. Entrepreneurs Author of The Art of Startup Fundraising & Serial Entrepreneur  Henrique Dubugras has accomplished more in just 22 years than most entrepreneurs aspire to in a lifetime. He’s started multiple companies, won coding competitions, attended some of the most envied learning places, started multiple companies, hired hundreds of people and raised millions of dollars. How has he done it? What secrets to success can he share with other entrepreneurs? I had the pleasure of interviewing Henrique Dubugras on a recent episode of the Deal Makers Podcast. Here’s a glimpse at his story behind the scenes, and his tips for raising millions of dollars, landing top tier investors and more (listen to the full episode here). Young Entrepreneurship Henrique started striking out with his own businesses at just 12 years old. Being obsessed with online gaming he decided it was best to learn to code, build his own games, and play for free. Unfortunately, just two years later he got hit with a patent infringement notice at just 14 years old, and had to shut it down. Hacking Your Way into Stanford After discovering a TV show called Chuck, who was a really good programmer and hacker, Henrique decided, "If I want to be like Chuck, I have to go to Stanford." As a foreigner, he found the whole U.S. college application process very complicated. So, he found another Brazilian guy that was graduating from Stanford. They made this deal. He was starting a ticketing company in Brazil. He would teach Henrique the Stanford application process, and in exchange, he would code for him for free. After working for him for a year, his mentor had raised a bunch of money and hired a bunch of senior engineers. Dubugras thought, "Hey, maybe I can try to start my own company." He decided to start a company that teaches other students the U.S. application process. Despite getting to 800,000 uses in just nine months, it became pretty obvious that the user base didn’t really have the money or credit cards to pay. Their parents were also skeptical. The love for that venture faded out as he found new opportunities. Winning the Miami Hackathon & Raising $300K at 16 Rent is expensive, so Henrique headed to a hackathon in Miami that was worth $50,000. He built this dating app called Ask Me Out, which instead of Geolocation, was through Facebook friends. He won the hackathon, went back to Brazil and tried to launch that. He and his cofounder ended up transitioning to a payments startup, Pagar.me, which is like Stripe in Brazil. The connections made led to raising $300k from two investors at just 16 years old. They scaled to 150 employees and decided to sell the company and go back to school. Lessons Learned on the Journey Some of the early lessons Henrique Dubugras says he learned along the journey in those early ventures were: 1. To aim big, not just for what could be big in one country, but could be done at a global scale. 2. Monetize early to prove your business model and commercial viability. 3. Relying on others, like banks, to run your business can be tedious, risky and derail your product. Leaving a Half-Billion Dollar Business to go Back to College Most workers or entrepreneurs couldn’t fathom wanting to go back to school after having grown a $500,000,000 a year business. Henrique and his cofounder Pedro did. Four reasons that drove their decision were:

After attending the prestigious startup accelerator program, Y Combinator, the pair of cofounders dropped out of Stanford. Why not? They probably knew more than many of their professors from first hand experience, even before they got it. The Irony in Raising Millions of Dollars for Hot Startups Going through startup accelerator Y Combinator, Henrique realized the irony of so many successful founders that were raising millions of dollars, yet couldn’t get a simple corporate credit card. Crazy, right? You have millions of dollars in the bank, top investors and financiers in the country love you, but you can’t use the money. Often due to short financial history. So, Henrique’s next startup became offering a corporate credit card to these founders. It went live in 2018. It’s called Brex. Who to Hire & How to Land a Super-Angel Henrique has learned from the best and has hired hundreds of people through different startups. With Brex he says his first hires were a generalist, a CFO, and then general counsel. All of which helped to build credibility with investors. Something particularly useful when raising money when you are just 21 years old. Brex has now raised at least $220 million and is valued at more than $1.1 billion. Funding has come from names like Ribbit Capital, DST Global, Global Founders Capital, and SV Angel. Even Peter Thiel and Max Levchin are in. Henrique says they landed Max after having gone through the interview process at one of his companies, just to learn the recruiting process. The final interview was with him, and they have now found him to be one of their most helpful investors. That helpfulness is the top quality Dubugras says he looks for in an investor. Often working on building a relationship with them for months in advance to see just how helpful they’ll be. Quick Tips for New Founders

Listen in to the full podcast episode for all the details, as well as how to contact him directly with your ideas and questions (listen to the full episode here).  We take a closer look at what it feels like to be a woman making six-figures — when only 5% of American women make that much, according to the U.S. Census — with the hope it will give women insight into how to better navigate their own career and salary trajectories. We talked with a marketing manager from Seattle, WA. Job: Marketing Manager, Tech Age: 28 Location: Seattle, WA Degree: Bachelor's in Marketing First Salary: $40,000 Current Salary: $150,000 As a kid, what did you want to be when you grew up? "It took me a long time to realize that I can succeed in both qualitative and quantitative fields. I used to really enjoying writing short stories when I was younger and thought that I might become a professional writer as an adult, but that interest dwindled after too many boring writing projects in college." What did you study in college? "I have a bachelor's degree in business with a focus on marketing." Did you have to take out student loans? "My mother put money away throughout my entire childhood to help fund my education because her parents had funded hers, so I only had to take out $3,000 worth of loans for my bachelor's degree. I also did many, many internships, some unpaid, and my mother helped pay for living expenses during those years." Have you been working at this company since you graduated from college? "I graduated college only a few years ago (I'm a late bloomer) and did five internships while in college because most of my degree was completed online. Since graduating, I've had four different jobs, so I haven't stayed anywhere for longer than a year. I think this has greatly contributed to my quick salary growth." How would you explain your day-to-day role at your job? "I usually check email first and respond to anything that I didn't feel comfortable knocking out on my phone. Next, I check business intelligence reports to review the status of our business from the last day or two. Every day is different, but at that point I might have a meeting or two, take lunch, and then start working down a list of projects. My job is incredibly chill, and I'm able to pace my day out however I want, and I can usually come in late and leave early. It's pretty great." Did you negotiate your salary? "I'm in a somewhat specialized area of marketing, so I tend to get offers towards the top of salary ranges. That said, I did attempt to negotiate my base salary at my current company. They gave me a very small bump, but ultimately I was more successful negotiating for stock and work-from-home benefits." Is your current job your “passion”? If not, what is? "Definitely not. I started out in fashion — an industry I really did love — right when I graduated college. But the pay was so much lower that I ultimately decided to prioritize salary and made the switch to where I am now. I sleep well at night knowing that I'm setting up a financially secure future for myself, but I wish I didn't have to sacrifice the best years of my life for a paycheck. I hope that I'll find an out one day." If you could, would you change anything in your career trajectory? "I wish that I could somehow gain the ability to see what life might have been like if I had pursued something more fun and 'me,' but I do think I've ended up in a really good place in the world. I have no idea how things might have gone with any trajectory shift, so I probably wouldn't choose to change anything from the past." What professional advice would you give your younger self? "Stop prioritizing shallow friendships over your career. Those people are bringing you down and distracting you from any kind of real growth. Don't be afraid to be alone and leave your comfort zone to find out what you're really capable of without the influence of others. Also, spend more time with coworkers. Network and build relationships, because work is going to be miserable without people to eat lunch with. Also, finding your next gig is going to be a lot more difficult without help."

By Bob Haegele Personal finance blogger at The Frugal Fellow

There are a lot of personal finance books. Sure, not as many as there are blog posts on personal finance, but still. There are a lot of them So how do you decide which ones are the best ones to read? To help answer that question, I’ve put together a list of the top personal finance books. Adding these books to your collection is sure to set you up for financial success.

Your Money or Your Life

Your Money or Your Life is somewhat of a foundational personal finance book. The author, Vicki Robin, published it all the way back in 1992. Yet it is is still around; this book has stood the test of time. Robin’s concept of “making a dying” is perhaps what makes this book so powerful. We all like to say we “make a living” – but what if it’s the opposite? Despite “money” being the second words in its title, the book poses more of a philosophical question than one of pure numbers. Do you want to work for someone else forever? Or do you want to take control of your life? I highly recommend reading this book to find out how you can do just that. Order your copy on Amazon.

The Simple Path To Wealth

Unlike Vicki Robin’s book, The Simple Path to Wealth really gets into the nitty-gritty numbers. JL Collins wrote it to lay out a simple, no-nonsense investing strategy that anyone can follow. Sure, it may be possible to see slightly better results with a more complicated strategy. But with Collins’s approach, you set yourself up for success with little effort. This book is definitely one of the best personal finance books of all time. Be sure to check it out! Order your copy on Amazon.

The Total Money Makeover: A Proven Plan For Financial Fitness

Many people in the personal finance community criticize Dave Ramsey. Some call him out of touch or privileged. In spite of this, his book, The Total Money Makeover: A Proven Plan for Financial Fitness contains some great advice. This is the pivotal book in Dave Ramsey’s arsenal. It contains his 7 baby steps plan. A lot of the bylines around personal finance sound grim nowadays. But the truth is that they don’t have to be. I’m confident that even lower-income people can avoid financial disaster with Dave’s steps. Total Money Makeover is a great personal finance book for beginners. It helps set the groundwork to set the reader up for financial success. It also has some of the best Dave Ramsey tips all in one place. No doubt, this is one of the best personal finance books of all time. .

Financial Freedom: A Proven Path To All The Money You Will Ever Need

It might seem bold to put a book that was only released a few months ago on this list. However, Grant Sabatier’s Financial Freedom is thoroughly deserving of a place here. I’ve mentioned Grant’s book several times in the past. And with good reason. The things he has been able to do have been nothing short of remarkable. He went from having $2.26 in his bank account to being a millionaire in just five years. At the start of his journey, he had lost his job and quite was – quite literally – almost penniless. But through (extremely) hard work, creativity, and determination, Grant managed to pull himself out of financial ruin. He’s now doing extremely well and has been featured on the many of the big news outlets. In Financial Freedom, Grant walks you through everything he did to reach a 7-figure net worth in a hurry. You don’t want to miss this one!

I Will Teach You To Be Rich, Second Edition

This book is worthy of a place on the list because of its no-nonsense approach to finances. Not only that but as the name implies, I Will Teach You to Be Rich, Second Edition is a refresh on an old classic. While this edition was released a matter of weeks ago, the book was originally released in 2009. Ramit Sethi’s book is similar to Dave Ramsey’s in that it gives you a step-by-step approach. However, this book takes it a step further. It’s not just for beginners who want to gain a foundational understanding of personal finance. Instead, it gets into the weeds in terms of exactly what you should be doing with your credit cards, investments, and everything needed for financial success.

Rich Dad, Poor Dad

Robert Kiyosaki, the author of Rich Dad, Poor Dad is another personal finance who has come under fire. Much live Dave Ramsey, though, his reputation doesn’t change the value of his book. I personally like the approach in this book because it focuses on mindset. In addition, it challenges many of the established norms of finance. For example, Kiyosaki asserts that your house is not an asset. Some of his advice may be unconventional, but this book is sure to get you thinking differently. And sometimes, that is exactly what we need. Order your copy on Amazon.

Secrets Of Six-Figure Women

While I don’t often focus on women’s personal finance, Secrets of Six-Figure Women is undoubtedly worth a mention. Like it not (well, I hope you do!), women are earning more these days. While there are certainly still disparities in income and other workplace dynamics, things are changing. If you’re a female reader, there’s a good chance you would love to join the likes of other six-figure women. This book will break down exactly how to do just that! And these women are not just in one industry. They are all over the spectrum, but what they do have in common are certain characteristics. Do you have what it takes.

Stack Your Savings

Stack Your Savings is a book by S.J. Scott and it’s a bit of a hybrid of some of the others. It will hit you with facts about personal finance and help you change your money mindset. It will also tell you about the seven pills of money-saving habits. These are not necessarily sequential like those of Dave Ramsey. Nevertheless, these habits are sure to help you get your finances in order! Order your copy on Amazon.

Passive Income Freedom

Passive Income Freedom is another important book when it comes to mastering your finances. In fact, creating passive income streams is key to achieving financial independence. Although the color scheme of this book cover may make it seem women-focused, the reality is that anyone can find value in it. And just like I mentioned, this personal finance book focuses has a financial independence theme. So if you’re ready to escape the rat race and take control of your finances, be sure to check this one out! Order your copy on Amazon.

How To Stop Living Paycheck To Paycheck

Rounding out the list of the best personal finance books of all time is How to Stop Living Paycheck to Paycheck. And that is no coincidence. You may have heard the stats that keep cropping up about how Americans can’t cover a $400 emergency. 40% of us, apparently. If you aren’t able to cover a $400 emergency, that is the very definition of living paycheck-to-paycheck. It’s mind-boggling to think 40% of Americans are in this position. By no means do I fault anyone for being there, though. There are a lot of things I could say about this, but the truth is that most of these people are probably not at fault. That’s why a book like this is so crucial right now. If you are living paycheck-to-paycheck, this is the personal finance book for you! Order your copy on Amazon.  BY GEOFFREY JAMES, CONTRIBUTING EDITOR, INC.COM Musk is as innovative a management theorist as he is an inventor and business owner. Who knew? Elon Musk is best known as an innovator, business owner, visionary, and bon vivant. What gets lost in that public image, though, is that he's a management theorist. Musk seems to approach running a business much as he'd approach a complex engineering project: Figure out what works and do that, even if it doesn't make sense to anyone else. About a year ago, Musk wrote an email to his employees at Tesla that neatly encapsulated his thoughts about management and corporate culture. I've written about parts of that email previously but only recently realized that, in 11 short rules, Musk laid out, well, basically everything you need to know about management. Here's my edited version:

Now, I've heard and given some of that advice before (notably, numbers 4, 6, and 9), but the remaining eight points are not only highly original, they're also "cut the Gordian knot" solutions to the knottiest problems that plague most companies. Seriously. As an author and reviewer of business books, I'm pretty aware of what turns up in that kind of literature. Management theory hasn't changed in 50 years. I haven't seen or read anything really new in terms of management technique for, gosh, at least the past two decades. So here's Elon Musk--boom!--slapping 11 techniques, of which eight are 100 percent original and iconoclastic. This tour de force is as amazing in its own way as the successes of Tesla and SpaceX; more amazing, maybe, because those successes might have been possible only because Musk rethought how companies should be run. Anyway, publishers send me business books to review and I've built up quite a library of "to read" volumes. After reading Musk's letter, though, I looked up at that shelf and thought to myself: Why bother? I could read that entire library and not get as much true business wisdom as Musk crammed into a single email. So I threw the books into a crate and carried them out to the recycling bin. If you have a skill set that people need you could become a freelancer. Anything from proofreading to copywriting to graphic design and even photo editing are options to explore. Freelancer.com is the world's largest freelancing and crowdsourcing marketplace by number of users and projects. They connect over 44,473,816 employers and freelancers globally from over 247 countries, regions and territories. Through their marketplace, employers can hire freelancers to do work in areas such as software development, writing, data entry and design right through to engineering, the sciences, sales and marketing, accounting and legal services. Register as a freelancer and start earning. Click Here to claim a $20 gift from Bergen Review Media just for creating a Freelancer account. Become a FIVERR freelancer.Become a FIVERR freelancer. Create a Gig of the service you’re offering and start earning instantly CLICK HERE

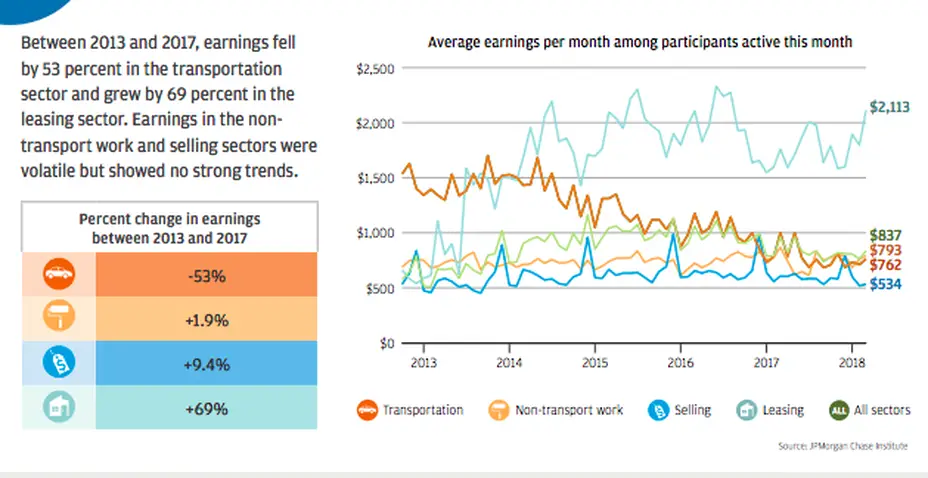

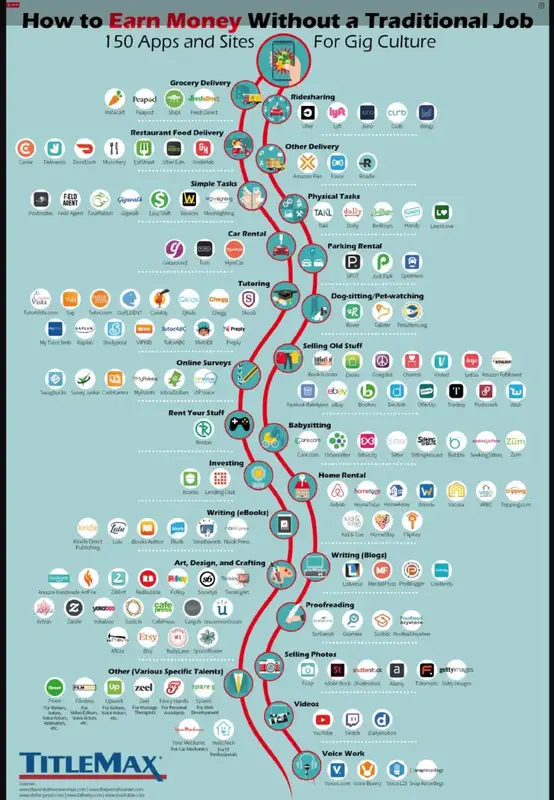

From Airbnb to Uber to eBay, these apps may help you earn some dough in the gig economy. Working 9 to 5: What a way to make a living. Or not. Roughly one in four Americans now earns at least some of their income from the gig economy — be it driving an Uber or Lyft, selling goods online on a site like eBay or babysitting through Care.com — according to research published in 2018 by market research firm Edison Research. For 44% of gig workers, that side hustle is their primary source of income. So what are these workers earning? It varies widely (though it’s important to point out that it’s often not enough, as 80% of gig-economy employees whose work is the primary source of income say that an unexpected expense of $1,000 would be difficult to pay, Edison found). People who participate in the leasing gig economy (like renting a home on Airbnb) earn the most, at over $2,000 a month on average, according to data from JPMorgan Chase. But most others earn significantly less with the average across sectors only about $800 a month.

Despite sometimes low earnings, people choose gig work for a variety of reasons, including flexible scheduling and loss of a traditional job. And thanks to myriad apps and sites, they have a lot of options for side hustle work — as this fascinating graphic from lending company TitleMax shows.  Everyone who’s saddled with bad credit has a unique story. A man burdened with $6,000 in unpaid bills. A mom of nine held back by an error on her report. A couple recovering from job loss and foreclosure. A single mom with a terminally ill child. A young woman with so much debt she couldn’t even get a credit card. What all these people have in common? They used a free online service called Credit Sesame to improve their credit scores — one man got his score up 277 points in six months.* If you need some motivation, read through these real-life stories. Chances are, you’ll find you have something in common with at least one of them. Then, take a look at your own score and get some personalized recommendations from Credit Sesame. It takes less than two minutes to sign up, and who knows? Your story just might end up in this article six months from now. Man Had $6,000 in Unpaid Bills — Then Raised His Score 277 Points Before discovering Credit Sesame, 50-year-old Atlanta resident James Cooper, had $6,000 in unpaid bills. He’d never had a credit card, and his credit score was 524. He tried using a credit repair service — one that promised to improve his score… for a fee. Needless to say, he got burned. Since Credit Sesame is free, he figured he’d give it a try. Within a few minutes, Cooper had access to his credit score, his total debt owed and even personalized recommendations to help him improve his score. “They showed me the ins and outs — how to dot the I’s and cross the T’s,” Cooper said. “I applied for my first credit card ever.” After opening a credit card, which improved his score, Credit Sesame recommended he request a credit limit increase. That too bumped his score up (re: credit utilization). In a span of just six months, Cooper watched his score increase 277 points. Now Cooper uses the lessons he’s learned from Credit Sesame to teach high school students the importance of good credit through his nonprofit, Fedup-4U. Mom of 9 Didn’t Know She Had an Error on Her Credit Report After Salome Buitureria got laid off, she struggled to find work and was forced to use credit cards. The bills stacked up, and her credit score dropped — to 524, which is considered “very poor.” Once she got back on stable ground, she started focusing on improving her credit. Her dream has always been to buy a home, and she knew the important role her credit score would play. She got on Credit Sesame and assessed her debt, and that’s when she found a major error — a supposed unpaid medical bill from when her daughter had been sick that’s definitely been covered by Medicaid. But here’s an unfortunate fact: One in five credit reports have errors, according to the Federal Trade Commission. Yup — you can do everything right, but an error could be holding you back. Credit Sesame showed Buitureria how to fix the mistake, then she took additional steps to raise her credit score from 524 to nearly 700. Now? She’s focused on buying a home. “We want a place where the kids can come home,” she says, “where they don’t have to worry, a year or two down the road, ‘Oh, Mom’s got a new house.’” Guy Falls on Hard Times and Couldn’t Stomach Checking at His Score In 2008, the housing bubble burst, and Jerry and Vivienne Morgan’s home fell into foreclosure. Not long after, Vivienne lost her job. “No one plans on being in that situation,” Jerry said. “Frankly, with the experiences we have gone through, I was embarrassed to even check my score.” Nearly 10 years later, the Morgans were gainfully employed and got approved for a mortgage remodification. Things were looking up, so Jerry decided to finally check his credit score… It hovered around 500. He came across Credit Sesame and decided to give it a try. He liked how the site clearly explained what affected his credit score — and how he could improve it. He opened another credit card (increasing his account mix and decreasing his credit utilization rate) and also took out an auto loan when he bought a new car (also boosting his account mix). Making on-time payments toward that loan helped as well. Within six months of signing up, Jerry saw his score increase 120 points. When we last talked to him, Jerry was continuing to take steps ot improve his score and felt hopeful of his financial future. Single Mom Overcame Credit Card Debt and a Bad Credit Score In 2005, Melinda Smieja’s 13-year-old daughter was diagnosed with a terminal brain tumor. “So here I am, a single mom, and my daughter gets sick,” she said. “And I’m like, ‘What am I gonna do?’” She used credit cards for dinners and a place to stay. Soon, she’d maxed them all out — 11 cards, to be exact. She had somewhere between $20,000 and $30,000 in debt. Her credit score was down to 480. Then she stumbled upon Credit Sesame. It quickly made her overwhelming situation way more manageable. “I could look and I could say, ‘OK, this is what’s all going on here. This is my debt. This is what’s happening. This is what’s making my credit [interest] high,’” she said. And she could finally tackle her debts, one at a time. The work wasn’t quick. It was slow and steady — but it paid off. In 2016, for the first time, Smieja’s credit score hit 680, crossing the line of what lenders consider “good credit.” By late 2017, it was up to 764. 30-Year-Old Was Stuck in Debt and Didn’t Know Where to Go At 30, Dana Sitar’s history with credit cards, student loans and medical bills was tough to face. Student loan interest was piling up. Hospital bills were out to collection agencies. No one would give her a credit card. She landed a loan for a new car by the skin of her teeth. Her security deposits for car rentals and apartments were through the roof. She wanted to fix it but didn’t even know where to start. Then Sitar, a personal finance editor, found Credit Sesame in 2016, and today, she’s breathing a little easier. Credit Sesame is “answering all the questions swirling in my head, keeping me awake at night and threatening a panic attack every time I authorize a credit check,” Sitar wrote in an article for The Penny Hoarder. Since she started tracking her credit score with the app, she’s watched it rise — slowly but surely — by 68 points, thanks to Credit Sesame’s recommendations. “It offers real recommendations you can use — one step at a time — to get out of a very confusing hole,” she says. Heck, it even let her know she could refinance her car loan and save a ton of money on interest over time. She’s also been able to find a credit card she could actually qualify for. Since signing up, Sitar has caught up with her student loan payments and is even ahead on her car payments now. Her goal is to improve her score a little more so she can qualify for a personal loan to consolidate her debt. Inspired? If you want to see how you can improve your credit score, signing up for Credit Sesame is totally free — and it only takes about 90 seconds to get started. *60% of Credit Sesame members see an increase in their credit score; 50% see at least a 10-point increase, and 20% see at least a 50-point increase after 180 days. Credit Sesame does not guarantee any of these results, and some may even see a decrease in their credit score. Any score improvement is the result of many factors, including paying bills on time, keeping credit balances low, avoiding unnecessary inquiries, appropriate financial planning and developing better credit habits.  What do you want to accomplish next with your money? Do you need to save more? Invest? You’ve done it. You’ve built up a little cushion in your bank account — $1,000! It feels good, right? Those days of checking your account balance in a panic are behind you. Congrats! You’re on the right path. Now it’s time to think about some longer-term goals. What do you want to accomplish next with your money? Do you need to save more? Do you want to buy a home someday? Invest? What’s the next step you should take? What are some specific things you can do to take your finances to the next level? We’ve got some ideas for you: 1. Invest in Real Estate (Even if You’re Not A Millionaire) The stock market can be a scary place. Stock prices shoot up and down like a roller coaster ride, and who knows when the whole thing might crash? It would be nice to diversify and invest some of your money in real estate, but don’t you have to be wealthy to do that? Now you can invest like the 1% does, and all you need to get started is $500. A company called DiversyFund will invest your money in commercial real estate — specifically, in apartment complexes that it owns — and you only need $500. Real estate can potentially earn you more money than the stock market. Over the long term, investing in the stock market will earn you an average annual return of 7%, adjusted for inflation, according to a number of studies. DiversyFund can’t guarantee how its investments will perform in the future — no one can — but historically, it has earned an annual return of 17% to 18%. So you don’t need a fortune to invest in real estate. All you need to get started is $500. 2. Secure Up to $1 Million in Life Insurance; Rates Start at Just $5/Month Have you thought about how your family would manage without your income after you’re gone? Chances are your checking account balance won’t last forever. Now’s a good time to start planning for the future by looking into a term life insurance policy. You’re probably thinking: I don’t have the time or money for that. But your application can take minutes — and, if you’re approved, you could leave your family $1 million by spending a low monthly fee on term life insurance with a company called Bestow. The peace of mind of knowing your family is taken care of is priceless. If you’re under the age of 54 and want to get a fast life insurance quote without a medical exam or even getting up from the couch, get a free quote from Bestow. 3. Ask This Website to Help You Pay Your Credit Card Bill This Month You’ve finally got some money in the bank, but do you still have some lingering debt? We found a company that will pay your credit card bill this month. No, like… the whole bill. Your credit card is getting rich by ripping you off with insane rates, but a website called Fiona wants to help. If you owe your credit card companies $100,000 or less, Fiona will match you with a low-interest loan you can use to pay off every single one of your balances. The benefit? You’ll be left with one bill to pay each month. And because personal loans have lower interest rates, you’ll get out of debt that much faster. Plus: No credit card payment this month. Fiona won’t make you stand in line or call your bank, either. And if you’re worried you won’t qualify, it’s free to check online. It takes just two minutes, and it could help you pay off your debt years faster. 4. Grow Your Money 11x Faster — Without Risking Any of it You’ve probably heard the best way to grow your money is to stick it in the stock market and leave it there for, well, ever. But maybe you’re just looking for a place to safely stash it away — but still earn money. Under your mattress or in a safe will get you nothing. And a typical savings account won’t do you much better. (Ahem, .09% is nothing these days.) But a debit card called Aspiration lets you earn up to 5% cash back and up to 11 times the average interest on the money in your account. Plus, you’ll never pay a monthly account-maintenance fee. Aspiration also shares part of its earnings with environmental charities, among other worthy causes. So you can stick up for the planet — without even having to write a check. It takes just five minutes to sign up for an Aspiration Spend and Save account. 5. Withdraw $5 and Buy a Piece of a Corporation Take a look at the Forbes Richest People list, and you’ll notice almost all the billionaires have one thing in common — they own another company. But if you work for a living and don’t happen to have millions of dollars lying around, that can sound totally out of reach. That’s why we like the app Stash. It lets you be a part of something that’s normally exclusive to the richest of the rich — buying pieces of other companies. But Stash lets you start with as little as a $5 investment. You can buy pieces of well-known companies, like McDonald’s, Apple, Tesla* and more. The best part? When these companies profit, so can you. Some companies even send you a check every quarter for your share of the profits, called dividends. It takes two minutes to sign up, plus Stash will give you a $5 sign-up bonus. (You just doubled your money!) You might not be in the next issue of Forbes, but this is a great way to get started. This article originally appeared on The Penny Hoarder  When it comes to buying everyday necessities, you rarely question the prices because they’re must-haves in your life. Even when an item isn’t a necessity, you may still want a specific thing and don’t think twice about what you’re paying. However, there are a few things that you’re definitely paying way too much for. Keep these seven overpriced items on your list because you can save a lot of money on them every time you head to the store. 1. Ibuprofen According to GoodRx, the average retail price of Ibuprofen is about $13.89. If you’re constantly reaching for name brand bottles like Advil or Motrin, you could save by buying the generic brand instead. The ingredients are often exactly the same, yet name brands often mark up the price by 15 to 30 percent. So if you’re tired of overpaying for no reason, talk to a pharmacist and find the cheaper brand that’s right for you. Pro tip: GoodRx has a ton of coupons that you can quickly download to save on both over-the-counter and prescription medicines. 2. Laundry Detergent Like ibuprofen, name brands often mark up their prices on laundry detergent, so you might be overpaying on those bottles and pods. To save, buy in bulk at a wholesale club store like Costco or on Amazon, and always use a coupon. Even better, consider making your own laundry detergent at home to save over 25 cents per load. 3. Toothbrushes Let’s be real — paying for a toothbrush could be one of the biggest wastes of money ever. If you’re good about going to the dentist at least two times per year, then you should be getting a free toothbrush every six months. Even though you should really be swapping it out every three months or so, only needing to buy two toothbrushes per year instead of four can help save you money. Pro tip: Ask your dentist for two free toothbrushes at your six-month checkup to save even more. 4. Wine It’s no secret that wine by the glass at a restaurant is often insanely overpriced. In fact, it can be marked up 400 percent per glass compared to the price you’d pay if you bought the bottle yourself at a store or from a distributor. Save by buying wine in bulk and then bringing it to a BYO restaurant. 5. Electricity While it may not feel like it, you’re most likely overpaying for your electricity. From leaving energy vampires plugged in to forgetting to turn off the light when you leave a room, it can add up. Simply upgrading to LED bulbs, smart plugs and other techcan save you hundreds of dollars over the next several years. 6. Jewelry Diamonds can cost between 50 and 200 percent more than their wholesale prices, so be prepared to drop a pretty penny at that jewelry store. If you can buy directly from a wholesale company, go for it. Other ways to save include compromising on the various factors that determine the diamond’s worth or even buying them online. 7. Makeup That concealer you love could actually be worth 78 percent less than you’re paying for it. Makeup is often marked up a lot and it might not always be worth it. So don’t hesitate to try lesser-known, budget-friendly brands that may have the same ingredients in them and stock up on free samples. 8. Books It really only costs a few bucks to print a book, so paying full price for a brand new paperback could be a total ripoff. Instead, sign up for your local library and pay nothing to read the latest work from your favorite author. If you’re more of a digital person, Amazon offers a ton of e-books for a third or less of what they’d cost in print. 9. Clothes And Shoes Designer jeans can often be marked up more than 80 percent from what it actually costs to make them, while sneakers might only cost $15 to make when they’re sold for $70 or more. Save money on both clothes and shoes by shopping sample sales, using Chrome extensions for the best coupons or even buying items gently used. 10. Produce Your local grocery store might be ripping you off by marking up the prettiest produce by as much as 75 percent. Yep, people will pay more for the prettiest produce, while the oddly-shaped rejects can be bought for 50 percent off. Save by seeking out the ugly fruits and veggies. If you can’t find them, ask the manager. There might be budget-friendly bananas in the back! Pro tip: Don’t even think about going for the pre-cut stuff. It’s even more overpriced! 11. Cards If you’ve gone to the store to buy a birthday, anniversary, graduation or greeting card lately, then you’re well aware that they aren’t cheap. Cards can often cost upwards of $6 even without the fancy music playing from them. So head to the dollar store instead, where you can end up paying at least 80 percent less on one card. Before buying anything, do your research to see what it actually costs to produce it and then what the average retail price is at the store. You could save a lot of money by buying items with smaller profit margins and lower markups. However, not every item will have a more budget-friendly option for sale, so stick to couponing and shopping with a smart strategy, too.  Erin Lowry of "Broke Millennial" shares her advice on how to take your first steps toward financial freedom.Before you look to invest, you need enough money in an emergency fund to cover three months of your expenses as well as your short-term goals. Want to be wealthy? You’ll need to invest, says Erin Lowry, the personal finance expert behind Broke Millennial and author of "Broke Millennial Takes on Investing: A Beginner’s Guide to Leveling Up Your Money".Millennials are in a good position to invest, because they can tap into investing’s biggest asset — time. “Time enables you to weather the ups and downs of the market. It lets you take advantage of compound interest for a longer period of time. And that’s what’s going to get you to your long-term goal of living comfortably and achieving financial freedom and independence,” Lowry says. Step 1: Set Your Financial Goals You need to get your financial life in order before you dive into investing. “It’s really important to write down your goals,” Lowry says. Then you can figure out when it makes sense to save v. when to invest. For your short-term goals, like moving or replacing your car, you might to save. That’s because investments in the stock market can rise and fall, and you won’t want to pull out your money when the market is down. For long-term goals like funding a child’s education, starting a business, or buying a house, investing might make more sense.

Step 2: Start with a retirement fund Have money in a retirement fund? You’re probably already investing. Lowry is on a campaign to change the way we talk about the money we put away for retirement. “We say ‘save for retirement’ but we are investing for retirement. People don’t think of themselves as investors, but they are. It’s important, because it can build confidence,” she says. Most employers offer either a 401k or 403b plan, and many will match part of your contributions. “If you can take advantage of the full match, that’s wonderful. If you can’t, start with 1 percent and every three to six months add another 1 percent,” Lowry says. If you’re self-employed, you can invest for retirement in an IRA, a SEP IRA, or a solo 401k. Lowry recommends putting aside 35 to 45 percent of your income to cover your taxes and your retirement investments if you work for yourself. She follows her own advice, putting 45 percent of every paycheck into a savings account. From that account, she pays her quarterly taxes and uses the money left over to invest in her SEP IRA. “This ensures I’m still prioritizing my future and investing for retirement instead of just putting it on the back burner,” she says. We say ‘save for retirement’ but we are investing for retirement. People don’t think of themselves as investors, but they are. It’s important, because it can build confidence. You don’t necessarily need to max out your retirement investments — it depends on how much money you think you’ll need in retirement, and what your other goals are. You can’t easily pull money out of your retirement investments, so if you have goals that are 10 to 15 years away, it might make sense to invest for those in tandem with retirement. In that case, you might not be able to max out your retirement savings. For 2018, Lowry didn’t max out her SEP IRA contributions, but she invested more than what a 401k would have allowed, since 401ks have lower limits. She feels comfortable with a high level of risk for these investments, since she’s 35 or more years away from retirement. So she invests about 90 percent of her portfolio in index funds. She and her husband also invest less than 5 percent of their monthly income into taxable investments they may use for a down payment on a house — a long-term goal for them. “It’s a modest sum because we’re focused on paying off my husband’s student loans right now, but I still like to balance in some investing,” she says. Step 3: Take the plunge Once you’ve organized your financial life and you’re saving for retirement, you’re poised to start investing on your own. Here’s what to do next: 1. Educate yourself Lowry says there’s plenty of credible information out there, no matter how you like to consume content — podcasts, books, blogs, magazines, or TV shows. She thinks the educational portals the brokerages provide are great tools, and you don’t have to be a customer to access them. “And I say this with a huge caveat — Reddit is always a place to go. The advice is worth exactly what you paid for it, but it’s a good jumping-off point for resources and a variety of opinions,” she says. 2. Decide how much you want to invest Some funds have minimum initial investments, so if you know you want a certain fund at a certain brokerage, check to see how much money you need to get started. If you don’t have much money to start with, microinvesting — investing small amounts of money — is an option. But Lowry says to watch out for fees. “A lot of apps only charge $1 a month. That sounds like such a bargain, and frankly it is,” she says. But if you’re only investing a couple of dollars a month, the fees can eat up all your returns. She recommends that you put in at least $25 to $50 a month. 3. Understand fees “Every dollar you pay in fees is a dollar less that’s compounding for the future,” Lowry says. The expense ratio, for example, is a common fee. But it can range from .04 percent to 1 percent. It’s not necessarily bad to pay a higher fee, but you need to be sure you’re truly getting value out of it. “I compare prices on different funds to ensure I’m getting the best value for my money,” Lowry says. 4. Do your research To find the right fit for your investments, ask friends, parents, and coworkers what they recommend, and look at online reviews. From that list, play around with the web sites and apps. “Especially for millennials, the user experience of the site can be make it or break it,” Lowry says. And make sure your investments are secure — look for two-factor authentication. Make sure whoever is working for you has your best interest in mind. That’s called the fiduciary standard. Another standard, the suitability standard, simply means that investments are suitable for you — they aren’t necessarily the best choices for you. 5. Contact your top choices “When you’re starting out, the process can feel really intimidating,” Lowry says. “Pick up the phone and call someone who works at the brokerage.” They can talk you through the nitty-gritty like how you’ll connect your bank account to your brokerage account. Plus, it will show you what their customer service is like. Not sure if investing is right for you? If you’ve followed all these steps you’ve likely overcome the biggest barrier to investing: fear. Still, if you’re just not comfortable with investing, that’s okay, Lowry says. She shares something she learned: You don’t have to invest. You just have to understand that when you do invest, your money does the heavy lifting for you. If you don’t invest, you’ll have to save a lot more to meet your goals.  Some of the sage's best advice applies to our most important asset--our kids. It's not too shabby for us, either. When we think of all that we want for our children, for them to be successful, to do well in school, or to just be happy, it can feel lofty and even daunting. But there are plenty of practical, everyday things we can do to help them thrive in simple, but powerful ways. Like teaching them how to be good with money. Instilling them early with good financial habits is a gift that keeps on giving. It's an understandably de-prioritized or even overlooked part of parenting, but I've enrolled the help of the very best to make it an easy add-on. Warren Buffett seems to know a thing or two about finances and his best advice on managing money is fantastic for children to ingrain now (and for mom and dad to learn too). 1. How you are with money is just as much a moldable habit as anything else. We try to teach our kids to be polite, kind, and respectful. We want to teach them good manners and develop habits of punctuality and hard work. Their mindset towards money is a habit too, one that can lead to always having enough money on hand or living paycheck to paycheck. The problem with developing bad habits with money is that they are quieter and more insidious than your average, daily bad habit. Buffett eloquently describes it this way: Chains of habit are too light to be felt until they are too heavy to be broken--you can have any habits, any patterns of behavior that you wish. It's a matter of what you decide. So step one is to view money management as a habit that needs to be built, early. I know, it's hard to prioritize when you're still trying to teach the importance of not waiting until the last possible minute for every single homework assignment to be done. But remember, this is a gift that keeps on giving. Let's go to the next point to get started. 2. A great financial habit comes from lots of little ones. Start small. First, teach the basics and secure little victories. Our 16-year old daughter had her own savings account and credit card pretty early on and is set up to talk to our financial advisor when she wants to. She just got her first paycheck for a summer job and is learning about taxes. After the basics, it starts with basic choices. If you buy this now, you won't have enough to buy that later. Buffett believes the key is to start with a small habit, a series of consistent choices, and keep at it until the impact becomes noticeable. How is it that child A was able to save up enough to buy her own car by high school while child B can't swing that? From choosing to ask for tap water at lunch instead of buying a triple-sugar frappe-whatever. We certainly haven't mastered this in our household yet, but we're making progress and the story's heroine is starting to see the difference it makes. 3. "Don't save what's left after spending; spend what's left after saving". This is a quote from Mr. Buffett, one that speaks to the need to "save from the top", or to set aside a percentage that comes right out of your paycheck and goes into savings (before you pay a single bill or buy a single thing). Start with a small goal of saving, say, 2 percent of every paycheck, develop a budget that tracks every cent spent, make little choices and keep adding to them to get to 3 percent saved a month, and so on. Of course, this requires living within your means, at a level that's comfortable but that challenges the definition of what's really needed to be comfortable. Let your kids see you role modeling this, calling it out when you're choosing a cheaper alternative or are choosing to not spend on something at all. 4. From day one, know the difference between bad debt and good debt. You can never start too early here because you can quickly get too far behind. Your child might soon be taking out student loans or maybe a business loan to get their budding business idea off the ground. While Buffett says no debt is always preferred, at least loans like this are investments in the future, as opposed to maxed out credit cards or cash advances. Sit down with your child to make sure they understand the difference to help prevent them from making a bad first move that soon becomes an albatross. So while you're working on helping to form all those other habits, don't forget the one that will literally pay dividends someday. |

Written, Compiled & Edited byThe Bergen Review Media Team

�

Archives

April 2024

Categories

All

|

|

Bergen Review Media is a

WebClientReach, llc Company |

50 East Ridgewood Ave. #215

Ridgewood, NJ 07050 Phone: (201) 948-5500 |

The Bergen Review is Bergen county's concierge for the best businesses, restaurants & venues in New Jersey. Our agency has a combined total of over 15 years experience in online media and marketing. Our team of experts scour every nook and cranny of New Jerseys best businesses, restaurants & venues to present to our clients the full scoop of where best deals & experiences are. Even after researching & looking at reviews, finding the REAL scoop on what Businesses, restaurants or venues best fit your interest can be a challenge. Bergen Review Media has a team that researches & visits various establishments. Making sure the consumer gets the best experience.

|

Website by Bergen Review Media

RSS Feed

RSS Feed